Until I started mindful spending, I didn’t understand what made me so apprehensive before salary day. Salary day was a day I always waited earnestly for because I’d spent everything from my previous salary, and a day I would later come to dread because I would spend all my monthly income trying to balance the past month’s debts. Later on, I’d try to improve on my spending, but it still didn’t matter because I wasn’t spending effectively.

Before I started mindful spending, I tried to remind myself of how much I needed to spend and how much I needed to save. The mind forgets, which is why we need reminders in our daily living. I drew up a plan that I visit every time to remind myself of the reason I started in the first place. A solid plan should be repeatable, organized, and agile.

What is Mindful Spending?

Mindful spending is being intentional about the way you spend your money and how your spending supports your goals. Satisfied Spending calls it lifestyle-based money management.

It is creating healthy spending habits that take you closer to your goals, instead of having your blood pressure rise when you think about what you’ve just purchased.

When you start spending mindfully, it becomes a part of who you are. You start asking yourself questions like these before moving money out of your account:

- Is this item in my shopping list?

- What is my reason for wanting to spend this money?

- What do I intend to achieve by saving this amount of money?

- Does making this purchase support my goals and needs?

- How do I intend to achieve my spending goal?

I’ve come to understand that many people are not comfortable with engaging in money conversation. However, it’s okay to own up to the fact that our spending habit sucks. Every other thing follows from here.

I started mindful spending with Google Sheets. Google Sheets has a budget template that I customized to my preference. With the 50/30/20 rule, I created a planning sheet that helped me organize my spending into different categories.

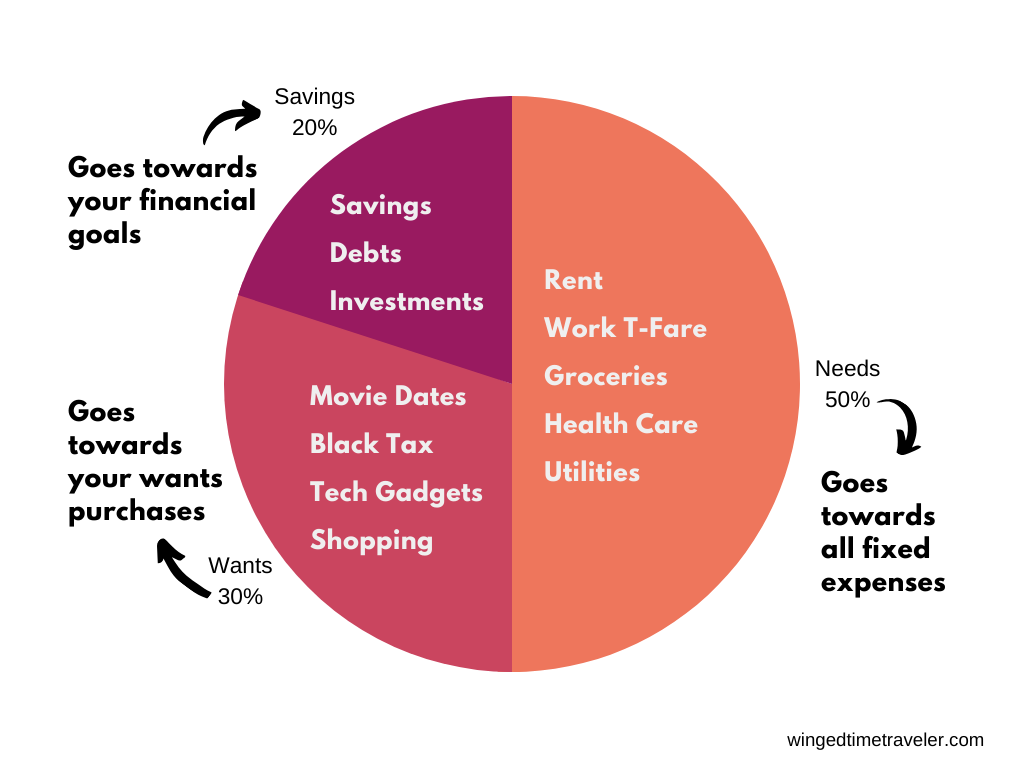

The 50/30/20 budget rule states that:

- 50% of your net income should go to your Needs, e.g. Fixed expenses such as rent, work transportation, health, bills, and utilities.

- 30% of your net income should go to your Wants, e.g. Lifestyle or flexible expenses such as food, travel, shopping, and even black tax, etc.

- 20% of your income should go to your Financial Goals, which includes all kinds of savings and investments.

The 50/30/20 rule is ideal for me because it’s helped me with simplifying and organizing my finances. With the planning sheet, I was able to see how much I needed for what, and how much I should be saving.

I have prepared a monthly budget template for August that you may want to customize to your preference. Click on ‘file’ to make a copy.

Confronting Black Tax with Mindful Spending

In simple words, black tax is the tax every first child pays for being born.

Tweet

As the first child of my family and the first grandchild on one side, I understand the responsibilities expected of me. Thinking about these responsibilities can be very overwhelming as you receive a text sometime in the middle of the month asking for money. You have a job, so nobody wants to hear you don’t have money. And heavens save you if they have an inkling of your monthly income. It’s okay to say you don’t have, but what about next month, and the upper month?

What I did was allocate some money for black tax under my ‘wants purchases.’ And in case the need is more than I budgeted, I wouldn’t do otherwise because I don’t have anywhere to unearth the money from, do I?

How do you measure what works with the monthly budget template?

As you spend and save, make every change in the sheet. At the end of the month, check back to see how much you’ve spent in the month. It’s okay if you spent more than you budgeted. The key is to take small mindful steps which in turn makes a big difference.

Make a copy of the sheet for next month with adjustment to your spendings. For example, if you budgeted N40,000 for food and you spent more than the amount you budgeted, adjust the expense for next month to the amount you spent this month and follow from there.

If you spent below the amount you budgeted, make the same changes.

I hope you’ve enjoyed reading this as much as I enjoyed writing it. Please fill out this 1 minute survey if you downloaded the monthly budget sheet. I’d love to follow up with you to make sure you find the budget template helpful. Don’t forget to follow my blog so that you don’t miss any blog posts from me. Also, remember to share with that friend who needs this most. Thank you.

10 replies on “How to practice mindful spending with Google sheets”

Thank you for this, Ifunanya! I am particularly glad that I learnt the term used to describe tax paid by most firstborns😂.

I also have the problem of mindless spending and pray that this template helps.

Here’s to being more intentional about the way I spend money 🍷

LikeLiked by 1 person

I’ll drink to that!

To making that money move, cheers, Amaka!🍷

Black tax is real, girl, and I’m glad you enjoyed reading it. Let me know your thoughts in the survey, yes?

LikeLike

This is so enlightening! First time I’m hearing “Black Tax” 😅

I’ve downloaded the template and I pray it works for me too. Thanks Ifunanya for this beautiful piece🤗

LikeLiked by 1 person

You are welcome, Doyin. 😊 Let me know if you find the template helpful in the survey. Happy budgeting 🦋

LikeLike

I love every bit of this.

LikeLike

I’m glad you love it! Thank you for reading!

LikeLike

This was such a good read.

How do you factor in emergencies though? Genuine and pressing emergencies from both friends and family? While “I cannot kill myself”, I have one too many times had to step out of my way to lend a hand. It ultimately upsets alot, especially long term. How do you deal with that?

LikeLiked by 1 person

Aren’t all emergencies genuine?

The truth is that the first thing I do with my income is to put away my 20% savings first. After all, Robert Kiyosaki said to ‘pay yourself first.’

And secondly, when such emergencies that I didn’t factor in occur, I deal with it as I’d deal with emergencies that aren’t mine. Try my best to help if there’s enough money in my family/ charity box, but if there isn’t, there isn’t much I can do then. If I want to help, I’d let them know that I don’t have that amount of money unless they can wait for next month.

Think of it this way, imagine you didn’t have such amount of money, what would you do? If you don’t have it planned, then you don’t have it. Would you be able to help out with a million Naira if you’re making less than a million Naira?

Thank you so much for reading, Nay!

LikeLike

This is great

LikeLiked by 1 person

Thank you so much for reading.

LikeLike