Question: Have you ever sat through a bad meal because you’d already paid for it and leaving would seem wasteful to you?

Once, I had held onto a skirt that made me look bloated because I wanted to get my money’s worth.

You may have heard the phrase, ‘cut your losses, ‘ it means to withdraw from a situation that is no longer serving you. Are you holding on to your job because you’re scared of the time and effort you’ve invested in it? Have you ever kept walking despite having the option to order an Uber because you’d covered a long distance and the oncoming vehicle might be your ride?

Cut your losses if you’d paid a crazy sum for an item. Instead of crying over money spent, it’s more helpful to learn from your experience and make a note to watch out for next time.

If you’ve encountered something like this, then you have experienced a psychological phenomenon known as a ‘sunk cost bias.’

A sunk cost is a cost that has already been incurred and cannot be recovered.

Wikipedia

Sunk cost fallacy explains the inclination to continue to invest time, effort, and money into an endeavour because of the costs we’d already incurred.

My Experience at Dodo Pizza 😱

Last weekend, I hung out with my friend, B, at Dodo Pizza. The Pizza restaurant is known for providing Pizza by the slice and whole Pizza, in Ikeja City Mall, Lagos, which is one of the things I loved about them — the freedom to buy a pizza slice instead of having to purchase a full box. Their vast food menu is something to drool over. This restaurant provides not just Pizza, but other meal options like Sausage rolls, Chicken wings, Cinnamon rolls, different flavours of Ice Cream, and the bone of contention – Dodster. I had always wanted to have a taste of their Dodster — A dish that boasted of fine dining and chunky delights. It looked like a Sharwama, but one that went to Grad school. However, on this day, they messed up my order, switching my Classic Dodster with B’s Beef Suya Dodster.

I did not have an idea of what the Classic Dodster tasted like, but as I bit into the hot baked wrap, I knew that this was a case of a sweet dream gone stale. Walking over to the counter, I asked if what I had gotten was the Classic Dodster, and they admitted they had mistakenly switched it up. I asked that they fix it, but they did not. The pizzaiolo who had prepared the Dodster came back to me with a message from the manager – he couldn’t care less. Their poor customer service oozed as they bade me farewell while I left their restaurant abandoning the hot baked wrap I’d purchased.

One thing about my Dodo experience is that I was able to call it quits when I could, although I felt sad that I didn’t get to eat the Classic Dodster, and peeved that the Dodo team didn’t consider me customer enough to treat me well.

It’s okay to call it quits when you can

Here’s the deal. It’s okay to acknowledge that we’ve made a mistake and move on. Calling it quits is better than holding on to that career that you loathe. It’s better to leave a toxic relationship regardless of how much time you’ve invested. If you feel like ordering an Uber, do it right away as the bus you keep waiting for isn’t coming. It’s okay to lose $1000 instead of putting more money into that investment with the hopes that this time would yield a better result.

It’s okay to know when to abort mission, sailor.

Concluding my Dodo Pizza Story

The chef had asked how I was sure I’d have liked the Classic Dodster if they’d prepared it. In answering his question, I wouldn’t know if I’d have preferred the Suya Dodster, but it would have been nice if I’d gotten what I ordered. Taking a second look at the menu, I also might have hated the Dodster because I don’t eat ketchup. If I’d ordered a second time, it might have turned to a case of the Sharwama that went to Grad school but couldn’t finish because it flunked classes. Either way, I might not get to try out Dodo Pizza’s Dodster again.

Lessons from Sunk Cost Bias

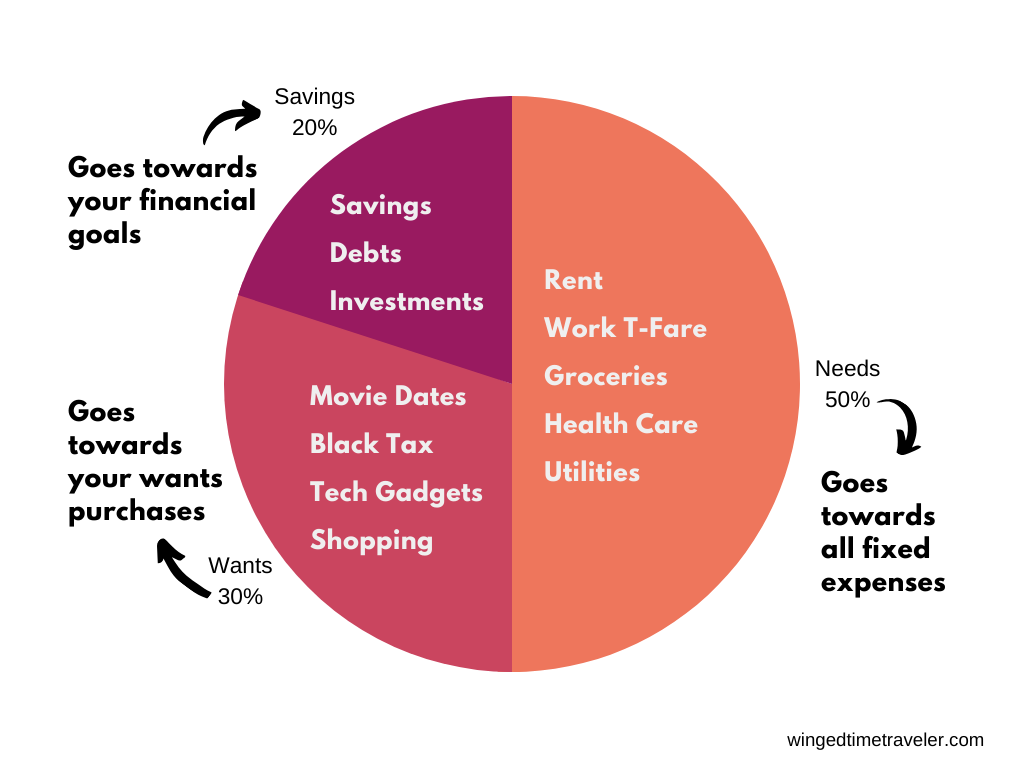

- Think of a sunk cost as money you’ve spent and cannot recover. This way, you do not depend on it to make decisions that will affect your future.

- Stop, once you realize that it’s time to move on to something else.

- Past mistakes are irrelevant. Accept what’s happened, understand that there’s nothing you can do about it, and move on.

- If you find yourself in a hole, stop digging. The point of no return only exists in our head.

- Invest in something new.

- Track your expenses and future opportunity costs.